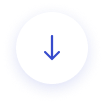

Indexing allows your retirement to participate and lock-in the upside market gains, but never in the downside market losses. The hypothetical example above shows how when a market index (such as the S&P 500) increases, the FIA

participates and locks in the gains, but when the market index declines, the FIA does not lose value.

With Indexing, your retirement is always safe and your principal and gains will never be lost due to market downturns.

We represent only those financial institutions that carry an “A” rating or higher with the major financial rating institutions (Moody’s, AM Best, Fitch, S&P). This means that they have excellent financial outlooks to secure your funds.

Furthermore, all companies are registered as Legal Reserve entities in the State you reside, so they have to prove each year that they have at least one (1) dollar of liquid reserves for each one (1) dollar of liability. Lastly, each State also carries a guarantee fund which the annuity companies pay into to provide an additional layer of security and guarantees.

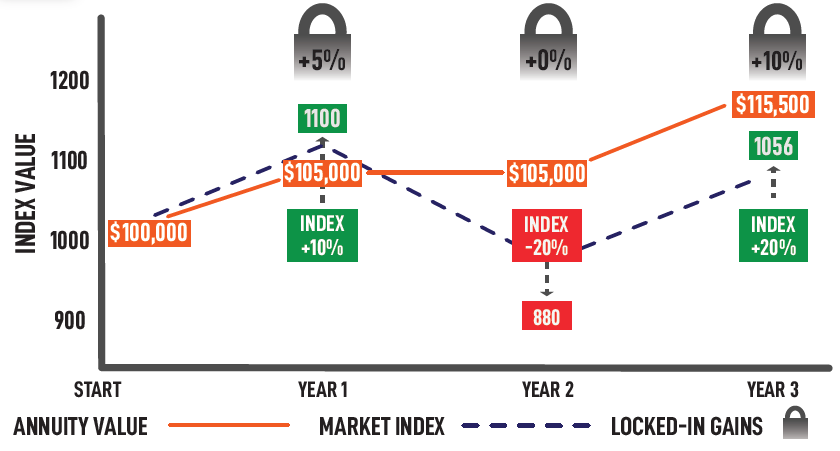

FIAs allow your funds to grow tax deferred. This results in Triple-Compounding Interest. You earn interest, you earn interest on your interest, and you earn interest on the money that you would have normally paid in taxes. Assuming a 25% tax bracket and a 5% annual gain, a $100,000 FIA would have 12% more after 10 years when compared to a non-tax deferred investment, such as a bank CD.

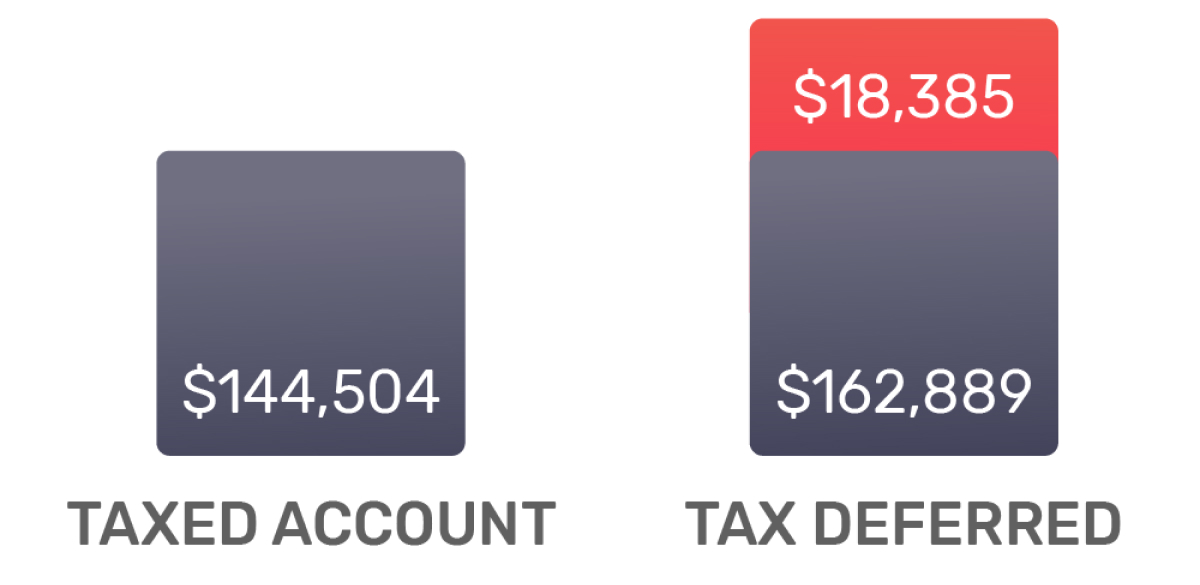

We can’t control the market, but we can control the fees we pay. Many of us are unaware what fees we are being charged and how it is eroding our nest-egg. FIAs can eliminate the fees seen in traditional equity investments, such as load fees, expense fees and 12b-1 fees. According to the Investment Company Institute, the average annual fees (expense ratio & 12b-1) for equity mutual funds were 1.50% per year. These fees, which offer no guarantee, can erode a substantial amount of your retirement over time.

The graph shows amount lost to fees of 1.50% over 20 years on a $100,000 investment earning 5%

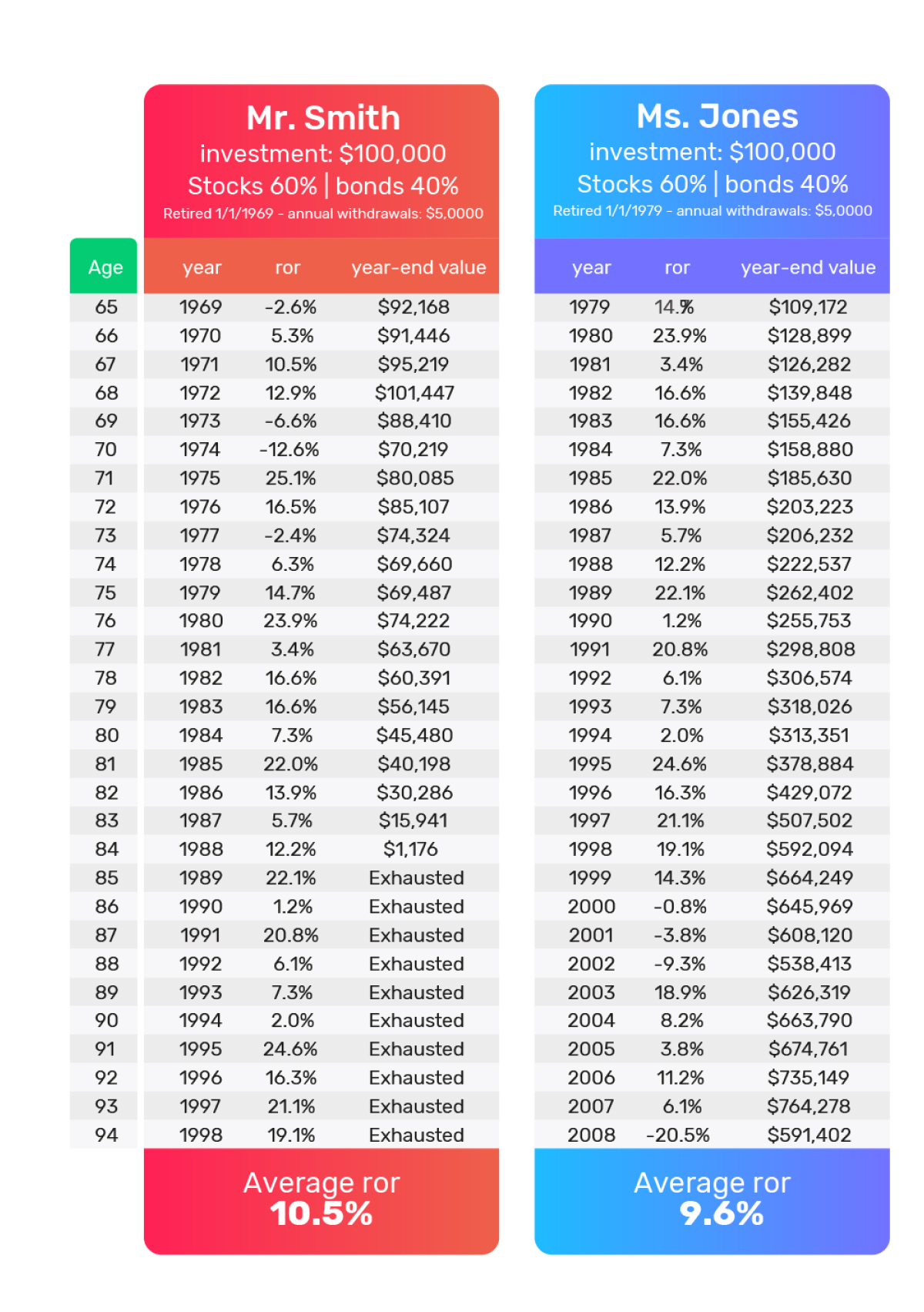

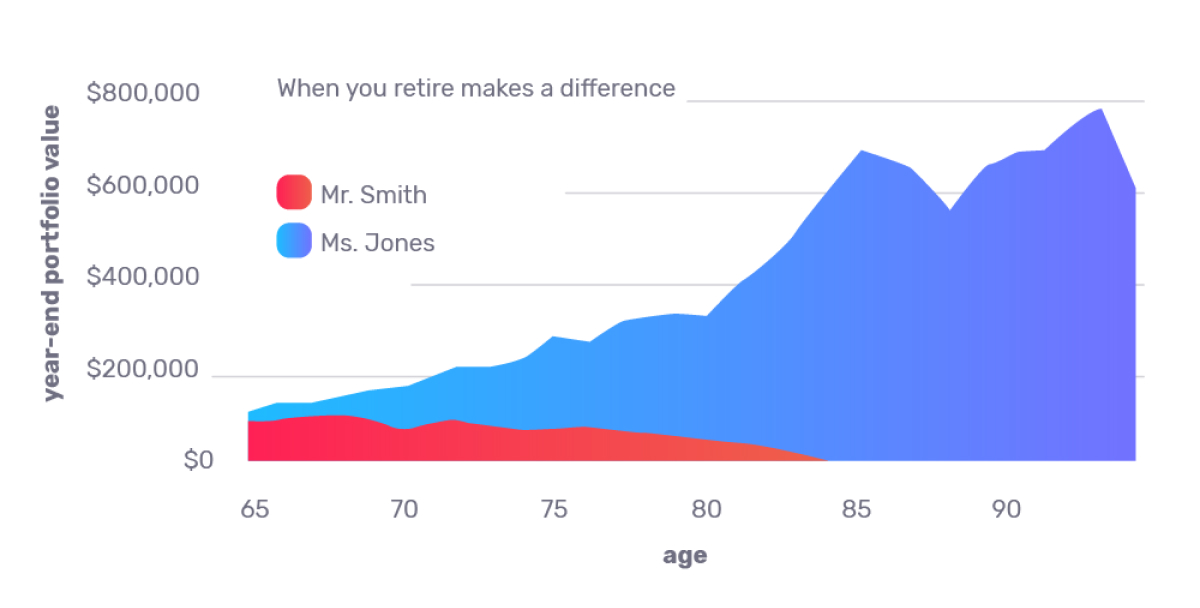

A very real and dangerous risk in retirement is Sequence of Returns Risk. This risk involves the order in which your investment returns occur. An investment portfolio, over time, might have a very favorable average annual return, but if a retiree experiences too many negative returns in a short period of time, while withdrawing funds to live off of, they could actually run out of money in retirement.

The graphic above shows actual market returns for different periods of time in U.S. history. Notice how the portfolio with the higher average annual returns results in depletion of the account by age 84 because of Sequence of Returns Risk.

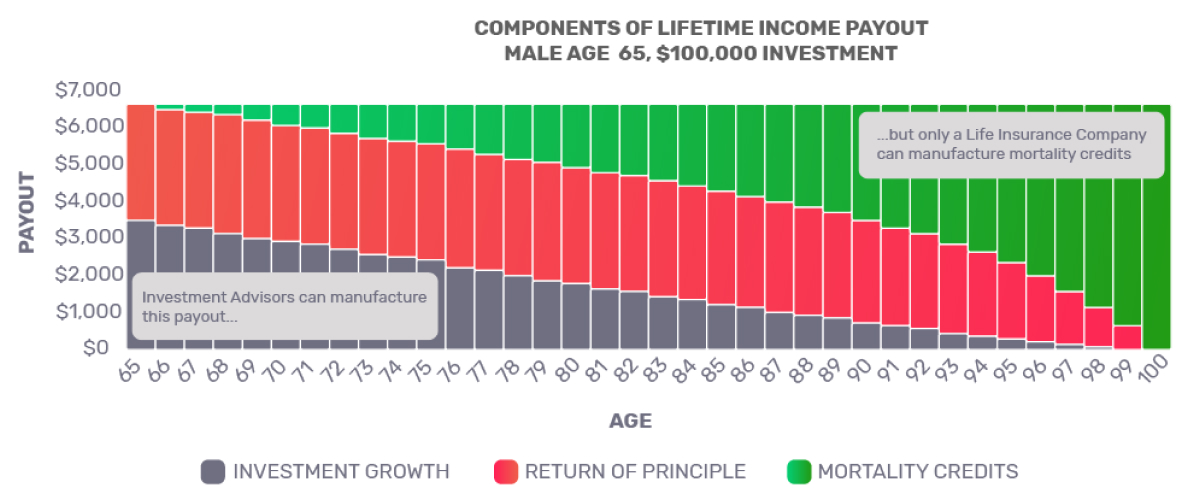

Only annuities can offer guaranteed lifetime income. Traditional investments can pay a retiree principle and investment returns, but annuities offer a third dimension called Mortality Credits, which are unique to annuities (FIAs). These Mortality Credits can provide higher withdrawal rates in retirement when compared to SAFEMAX rates and can guarantee a paycheck for life, even if the money has been depleted.

Annuities, just like life insurance, go direct to beneficiaries and avoid probate

According to LegalZoom.com, average probate cost is 2%-4% of the estate, with some states as high as 7%

If you had $300,000 in an annuity, you could be saving up to $21,000 in probate costs!

Tom Hegna, CLU, ChFC, CASL

Tom Hegna is an economist, author, and retirement expert. He has been an incredibly popular industry speaker for many years and is considered by many to be THE Retirement Income Expert!.

As a former First Vice President at New York Life, retired Lieutenant Colonel, and economist, Tom has delivered over 5,000 seminars on his signature “Paychecks and Playchecks” retirement approach, helping Baby Boomers and seniors retire the “optimal” way. He has condensed a large chunk of his considerable knowledge into 5 books.

Tom specializes in creating simple and powerful retirement solutions. He has the unique ability to pump up a crowd, make people laugh and solve complex financial problems using easy-to-understand words, ideas and stories. He’s been featured in Business, Forbes, Money Rates, and many other leading publications. He is available to speak with businesses, government organizations, professional associations, financial professionals and their clients across the globe.

Sean A. Ruggiero, CEP, RICP, WMCP, NSSA

Registered Investment Advisor

Registered Investment Advisor (CRD #7201706) CEP, RICP, WMCP & National Social Security Advisor Certificate Holder, Sean’s focus is on helping consumers and agents and agencies with retirement readiness through the use of evolving FIAs, education, training and software. Expertise in retirement income planning, wealth management, SaaS, insurance, credit, automotive, mortgage and finance verticals. Voted by Life Health Pro as one of “Top 20 Most Creative People in Insurance” for 2015. DIA award winner in 2016 Barcelona. Listed Top 100 InsurTech Startups by Digital Insurance Agenda 2016-2018. Marketing consultant for three of the top 60 insurance companies in the United States. Founder of SafeMoneySmart.org, a non-profit dedicated to the awareness of alternatives to the stock market in retirement. Author of “7 Benefits of FIAs for Retirement” (released 2021)

Tom Hegna

Sean A Ruggiero

Thanks for your message